During the summer of 2023, Onondaga County adopted its comprehensive plan, Plan Onondaga. This plan provides a framework for understanding where the county can focus its resources in order to foster economic growth and competitiveness and create and preserve communities where people can thrive. Housing is a key component of this plan.

Vision

Onondaga County will support affordable, attractive, and efficient housing and neighborhoods to retain and attract future residents.

Components of Housing and Neighborhoods

Plan Onondaga seeks to promote the development and preservation of complete neighborhoods, communities where all residents have safe and convenient access to the goods and services needed for daily life.

Complete neighborhoods include a variety of housing options for residents as well ass neighborhood amenities such as grocery stores, shops and offices, healthcare, quality public schools, public open spaces and recreational facilities, affordable active transportation options and civic amenities. A key element of complete neighborhoods is walkability and bikeability. Neighborhoods should be designed for multi-modal transportation.

Why Plan For Housing + Neighborhoods?

Housing needs and preferences are fluid and change over time. Catalysts for changing housing preferences include changes in household size and family configuration as well as shifting demographic attributes like age and population growth or decline.

Current lifestyle preferences like choosing transit or active transportation instead of driving, aging in place, renting versus owning, and an increased desire for walkable and bikeable communities are also influencing changes in neighborhood and housing needs.

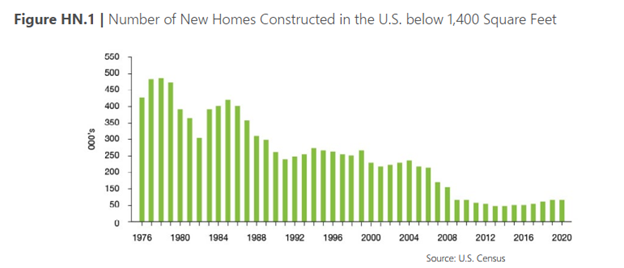

Increasing the current housing supply is a key component of planning for our current housing needs. Following the Great Recession (2007-2009) new home construction in the U.S. declined dramatically. In the decade that followed, fewer new housing units were constructed than in any decade since the 1960s. National estimates indicate 3.8 million housing units are needed to keep up with the rate of household formation in the United States.

Shifting demographic trends and lifestyle preferences are impacting demand for housing. Recent trends have been influenced by millennials and baby boomers increasingly seeking proximity to vibrant centers. These trends contribute to the demand and opportunity for creating Strong centers. These changing preferences have not yet been adequately met. There remains a lag in the market for appropriate housing in a range of types and prices located in walkable neighborhoods in proximity to and served by mixed-use town centers and transit-oriented development like Strong centers.

Because we know that housing needs and preferences are fluid and shift overtime, community planners and developers must be aware of these trends and respond to changing lifestyle needs and preferences. Shifting demographic trends and lifestyle preferences constantly change demands for housing types. Current trends have been significantly affected by major shifts in the preferences of baby boomers and millennials, two major population cohorts. Both millennials continue to retiring baby boomers have tended to increasingly seek proximity to vibrant centers in housing choice. These trends contribute to the demand and opportunity for creating Strong centers. For more than a decade, due to changing demand, many suburban areas around the country have experienced “urbanization” as traditionally suburban communities have seen growing demand for strong commercial centers with walkable communities and higher density housing along strong centers. However, despite this development trend, these changing preferences for millennials and baby boomers, are not being adequately met.

According to AARP’s Public Policy Institute, the vast majority of people age 50 and older want to stay in their homes and communities for as long as possible. This desire necessitates community planning that focuses on providing housing that is appropriate for an aging population, including ensuring that accessible senior housing is located within the communities where senior citizens want to stay. Community planning should also incorporate access to amenities such as needed services, parks, trails, and transportation networks near both existing housing and planned communities that are appropriate for senior citizens.

Older housing is often found in neighborhoods with existing sought after neighborhood amenities including sidewalks, narrower streets, and mature trees and landscaping, as well as appropriate lighting and proximity to parks and gathering spaces, community commercial area with local restaurants, schools, places of worship, libraries, and other community amenities. Older housing is often in need of upgrading or renovation; however, the added benefit of ready-built local amenities often makes it worth the investment. The U.S. Energy Information Administration has found that residential buildings built before 1950 are generally 30 to 40 percent less energy-efficient than those built after 2000. Maintaining or installing energy-efficient features, addressing repair issues, replacing worn-out appliances with modern energy-efficient models, and updating utilities throughout older homes will not only help improve the overall energy efficiency of the existing housing stock but will residents money and help address cost-burdens faced by homeowners.

amenities often makes it worth the investment. The U.S. Energy Information Administration has found that residential buildings built before 1950 are generally 30 to 40 percent less energy-efficient than those built after 2000. Maintaining or installing energy-efficient features, addressing repair issues, replacing worn-out appliances with modern energy-efficient models, and updating utilities throughout older homes will not only help improve the overall energy efficiency of the existing housing stock but will residents money and help address cost-burdens faced by homeowners.

Changes in Housing and Neighborhoods

Housing needs are not stagnant; they change over time as a reaction to the changing needs of a community and are often influenced by larger national trends. For example, the Post World War II period was characterized by demand for large neighborhoods of detached single-family homes was driven by family formation and the resulting population boom (baby boomers). However, recent demographic trends have shifted dramatically as households now tend to have fewer children, fewer married couples and communities’ age overall resulting in an increased demand for smaller housing units, including apartments and attached units.

New investment in our community, sparking a high potential for population growth and demographic changes will cause or housing needs to continue to evolve as our community moves forward.

Housing Choice

» Allow for various options including two-family, three family, and multi-family housing units in traditional single-family neighborhoods.

» Allow for ADUs, or accessory dwelling units. ADUs may serve as a much more convenient and affordable alternative for individuals trying to locate housing.

» Eliminate parking requirement minimums to prioritize housing individuals over cars.

Housing in Onondaga County

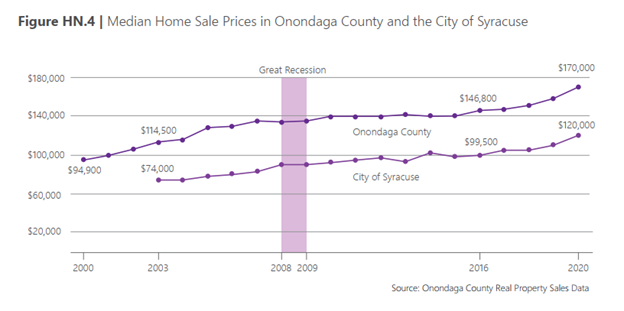

The housing market in Onondaga County has historically been regarded as affordable when compared to other markets around the nation. However, despite historic affordability, the cost of housing in our community continues to rise. However, building of new housing has not kept pace with the increase in home sale prices; the lack of new inventory to meet growing demand further drives up existing home sale prices placing additional strain on home buyers in Onondaga County. Changing preferences, financial constrains on the ability to own a home and available inventory have led to an increased demand for apartment units in Onondaga County, this increase in demand has led to a decrease in the vacancy rate of apartment units and an increase in rents. Rental prices in the Syracuse metropolitan area significantly outpace national averages. These trends are indicators of shifting housing preferences and needs within Onondaga County and demonstrate a need for more alternatives to traditional single-family detached housing.

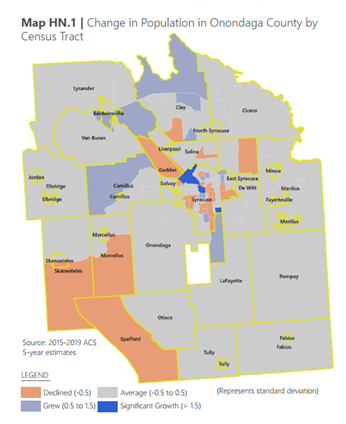

As of 2020 more people resided in Onondaga County than any decade since 1970. During this timeframe the population of the City of Syracuse grew by 2.4%. This was the first notable growth in population noted in the County in several decades. This trend represents a significant milestone for the region which had seen overall population decline. Changes in population have not been evenly distributed throughout the County; some regions experienced overall declines while others experienced population growth. Parts of the County including portions of Clay, Lysander, Baldwinsville, Camillus and the Town of Onondaga experienced increases in population resulting from new single-family home and multi-family unit construction. Growing neighborhoods within the city of Syracuse, primarily Downtown Syracuse, the Lakefront, and Syracuse University’s South Campus experienced the most significant population growth, as a percentage of change, this rapid population growth is associated with the development of new apartments and mixed-use projects that reflect the increasing demand for walkable and mixed use communities that has been occurring nationwide. Population decline was reported in the southwestern population of the County, this decline is likely related to the increased cost of housing in these communities as well as the growing demand for more dense and walkable communities.

construction. Growing neighborhoods within the city of Syracuse, primarily Downtown Syracuse, the Lakefront, and Syracuse University’s South Campus experienced the most significant population growth, as a percentage of change, this rapid population growth is associated with the development of new apartments and mixed-use projects that reflect the increasing demand for walkable and mixed use communities that has been occurring nationwide. Population decline was reported in the southwestern population of the County, this decline is likely related to the increased cost of housing in these communities as well as the growing demand for more dense and walkable communities.

Like many other counties in Upstate New York, Onondaga County’s population is older and aging. The median age is 39 and roughly 30% of households have someone 65 years old or older residing in them. Among households that own their home, roughly 31% in Onondaga County have a householder that is 65 years old or older. According to the Housing Needs Assessment, The county will have a significant growth in its senior population by 2040. The Assessment projects an increase of 2,000 senior renter households in Syracuse and 6,000 outside Syracuse from 2020 to 2040, mostly attributable to the aging of those already renting rather than new senior renters exiting the ownership market. Therefore, the County must prepare for the growing needs of an aging population. Aging populations often express a desire to stay in their home or stay in the local community as they age.

The population of aging homeowners has implications for local communities, the homeowner,

and their families, such as:

» Supporting homeowners who wish to age in place with accessibility issues, maintenance, and senior support services; and

» Providing adequate senior housing choices including options for homeowners who wish to downsize.

Despite increasing household incomes over time, the number of families living in cost burdened households remain significant in Onondaga County. A cost burdened household is defined by the U.S. Department of Housing and Urban Development (HUD) as a household that spends more than 30% of its monthly pre-tax income on housing costs, including rent or mortgage payments, utilities, and other housing-related fees. In Onondaga County, almost 50 percent (29,159) of renter households are housing cost Burdened and 25 percent (16,041) are severely cost burdened. Nearly 20 percent (20,663) of owner-occupied households are housing cost burdened. The majority of those households are located within the City of Syracuse. According to the Housing Needs Assessment, Non-Syracuse Onondaga County faces a substantial affordable rental housing challenge. Outside Syracuse, there are nearly 12,000 renter households with incomes below $50,000 that are paying more than they can afford for rent and therefore are considered to be living in a cost-burdened household.

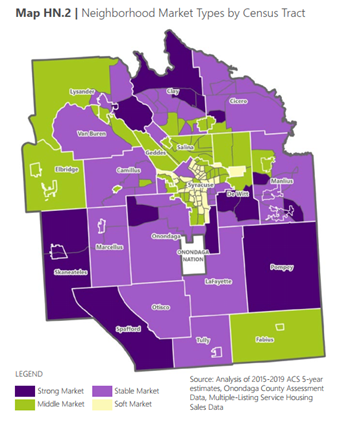

One approach to understanding housing trends in Onondaga County is to look at market related data. Careful review of market-based information can help policy makers and local officials consider specific strategies, policies, and/or programs that enhance or stabilize neighborhoods and increase the marketability and value of older housing depending on the local market conditions.

For Plan Onondaga, neighborhood market types were identified through a review of median single- family home sale prices for all arm’s length transactions (sales which include a Realtor) from 2016 through 2020, 2019 ACS 5-year estimates of median gross rent, and 2019 ACS 5-year estimates of median household incomes for each census tract in the County.

» Strong market – areas with significant population growth, the highest median home values, higher incomes, and considerable confidence in the market, but may lack affordable

confidence in the market, but may lack affordable

» Stable market – areas with positive population growth, higher median home values, and moderate to high incomes with market confidence that encourages investment in properties.

» Middle market – areas with declining populations, lower median home values, lower household incomes, but the strongest in overall affordability of the housing stock. As a result, these neighborhoods have experienced the highest percentage increase in home sale prices.

» Soft market – areas where there has been a significant decline in population, the most moderate increase in home values, the lowest median household incomes, and significant poverty. These neighborhoods have the least market confidence and require outside influence to encourage reinvestment in properties.

According to the Housing Needs Assessment, several issues unique to the post 2020 housing market have contributed to strains on housing availability and affordability. Supply chain issues and rising material and labor costs have impacted new home prices in the aftermath of the Covid-19 pandemic. This coupled with rising interest rates have placed new constraints on affordability and access to homeownership. These trends have made financing and purchasing a new home difficult for potential buyers and have contributed to many households opting out of purchasing a home and thus remaining in place. According to the Housing Needs assessment; the combination of 1) higher costs at the top of the market in new construction; 2) higher borrowing costs for all buyers, and; 3) relatively limited for-sale inventory is resulting in a “stuck” market as of 2024.

Planning for Housing and Neighborhoods

Quality housing and good neighborhoods are key components of maintaining quality of life in Onondaga County. Maintaining and improving the County’s housing stock while investing in neighborhood amenities and assets will help strengthen the County’s competitiveness.

Goal 1: Expand Housing Choice

In order to achieve long-term improvements in housing choice, a key component of housing affordability, tools and resources must be made available to local municipalities to promote the adoption of best practices in their plans and codes.

With County partners including the Onondaga County Planning Federation, the County can provide training, toolkits, and programs that can help local municipalities bridge gaps in knowledge or expertise to implement changes to the local regulatory and development review framework to allow for an expansion of the types of housing that are permitted.

The County can provide best practices and toolkits for integrating accessory dwelling units (ADUs) in local codes. ADUs may serve as a much more convenient and affordable alternate for individuals trying to locate housing.

The County can provide recommendations for reviewing and reducing local parking requirement minimums to prioritize housing individuals over cars.

Goal 2: Develop Targeted Market Driven Programs to Support Neighborhood Health

Neighborhood housing market based approaches can help local communities strengthen the tax base and provide a safe and healthy environment for residents.

Conduct a Housing Needs Assessment.

Support the efforts of the Land Bank and developers to remove and demolish dilapidated buildings that are unmarketable.

Build housing market confidence in soft and middle market neighborhoods by using available funding and programs to assist homeowners to make investments in their homes.

Strengthen connections between soft and middle market neighborhoods and job centers.

Work to address poverty, raise household incomes, increase access to living wage jobs, and education in soft and middle market neighborhoods.

Support interventions in middle and stable market neighborhoods to avoid decline and to ensure the long-term strength and appeal of housing in these neighborhoods.

Goal 3: Support and Enhance the County’s Housing and Neighborhoods

Onondaga County’s housing stock and neighborhood areas are key drivers of the quality of life in our community. Investment in existing housing and neighborhoods can ensure they maintain value and are competitive. When creating new neighborhoods, communities need to require the amenities, infrastructure and connections that create strong communities, support quality of life and create great places to live.

Plan for, codify and demand the amenities and quality of life infrastructure to create great neighborhoods by Empowering local government to demand features that support quality neighborhoods as part of the development process.

Continue existing and develop new Community Development programs that support the maintenance and improvement of the County’s aging housing.

Invest in parks, trails, and open space resources that enhance quality of life, strengthen property values and offer opportunities to connect housing and neighborhood areas with the County’s greenway and blueway systems.

Identify communities that would benefit from neighborhood retrofits, where the County can assist the local government and homeowners in a selected area to incorporate missing “complete neighborhood” features like sidewalks, trail connections, street lights, traffic calming features and street trees to increase the attractiveness and value in the neighborhood and enhance quality of life in the community.

In areas near schools, help local communities plan for and utilize Safe Routes to School funding to install neighborhood features that assist students walking or biking to school.

Continue to support and utilize Main Street and other housing programs administered by the County Community Development department.